Retirement before September 1st, 2014 and the Supreme Court Judgement

The EPFO office in New Delhi is informing all regional offices about a re-examination of pension cases for employees who retired before September 1st, 2014 without exercising an option under the pre-amended EPS’95. The directions are based on a Supreme Court judgement dated November 4th, 2022. The judgement states that employees who retired prior to September 1st, 2014 without exercising an option will not be entitled to benefits, but those who retired before the date while exercising an option will be covered by the provisions of the pension scheme as it existed prior to the 2014 amendment. For more complete details see the circular below.

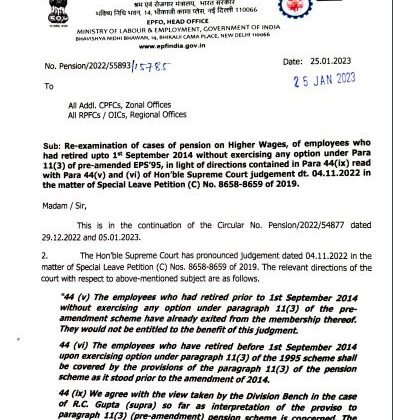

EPFO, HEAD OFFICE

MINISTRY OF LABOUR & EMPLOYMENT, GOVERNMENT OF INDIA

BHAVISHYA NIDHI BHAWAN, 14, BHIKALJI CAMA PLACE, NEW DELHI 110066

No. Pension/2022/55893/1 67.

Date: 25.01.2023

All Addl. CPFCs, Zonal Offices

All RPFCs / OICs, Regional Offices

Sub: Re-examination of cases of pension on Higher Wages, of employees who had retired upto 1st September 2014 without exercising any option under Para 11(3) of pre-amended EPS’95, in light of directions contained in Para 44(ix) read with Para 44(v) and (vi) of Hon‘ble Supreme Court judgement dt. 04.11.2022 in the matter of Special Leave Petition (C) No. 8658-8659 of 2019.

Madam / Sir,

This is in the continuation of the Circular No. Pension/2022/54877 dated 29.12.2022 and 05.01.2023.

The Hon’ble Supreme Court has pronounced judgement dated 04.11.2022 in the matter of Special Leave Petition (C) Nos. 8658-8659 of 2019. The relevant directions of the court with respect to above-mentioned subject are as follows.

“44 (v) The employees who had retired prior to 1st September 2014 without exercising any option under paragraph 11(3) of the pre-amendment scheme have already exited from the membership thereof. They would not be entitled to the benefit of this judgment.

44 (vi) The employees who have retired before 1st September 2014 upon exercising option under paragraph 11(3) of the 1995 scheme shall be covered by the provisions of the paragraph 11 (3) of the pension scheme as it stood prior to the amendment of 2014.

44 (ix) We agree with the view taken by the Division Bench in the case of R.C. Gupta (supra) so far as interpretation of the proviso to paragraph 11(3) (pre-amendment) pension scheme is concerned. The A ane authorities shall implement the directives contained in the said Judgment within a period of eight weeks, subject to our directions contained earlier in this paragraph.”

In this context, the factual position as narrated in R.C. Gupta & ors etc. vs Regional Provident Fund Commissioner, Employees’ Provident Funds Organisation & ors etc. dated 04.10.2016 is as follows: –

3.1 Paragraph 4 of the above judgement states:

” The appellant-employees on the eve of their retirement i.e. sometime in the year 2005 took the plea that the proviso brought in by the amendment of 1996 was not within their knowledge and, therefore, they may be given the benefit thereof, particularly, when the employer’s contribution under the Act has been on actual salary and not on the basis of ceiling limit of either Rs.5,000/- or 6,500/- per month, as the case may be. This plea was negatived by the Provident Fund Authority on the ground that the proviso visualized a cut-off date for exercise of option, namely, the date of commencement of Scheme or from the date the salary exceeded the ceiling amount of Rs.5,000/- or 6,500/- per month, as may be. As the request of the appellant- employees was subsequent to either of the said dates, the same cannot be acceded to.”

3.2 Relevant portion of Paragraph 8 of the above judgement states:

“… The said dates are not cut off dates to determine the eligibility of employer employee to indicate their option under the proviso to clause 11(3) of the pension scheme’.

3.3 Relevant portion of Paragraph 10 of the above judgement states:

“… both the employer and the employee opt for deposit against the actual salary and not the ceiling amount, the exercise of the option under paragraph 26 of the provident fund scheme is inevitable. Exercise of the option under paragraph 26(6) is a necessary precursor to the exercise of the option to the Clause under 11(3). Exercise of such option, therefore, would not foreclose the exercise of a further option under Clause 11(3) of the pension scheme unless the circumstances warranting such foreclosure are Clearly indicated’.

Accordingly, the direction of the Hon’ble Supreme Court in &.C. Gupta judgement pertains to such employees who had contributed on higher wages under paragraph 26(6) of EPF Scheme, and had further exercised their option under the proviso to erstwhile Para 11 (3) prior to their retirement, and their joint option request under the proviso to paragraph 11(3) was explicitly denied by concerned office of the RPFC and /or contribution on higher salary was refunded / diverted back to provident fund accounts.

Meanwhile, in order to stop over payment, if any, in respect of employees who had retired prior to 1%t September 2014 without exercising any option under Para 11(3) of the pre amended scheme, and have been granted pension on higher wages, their cases need to be re-examined to ensure that they are not given higher pension from the month of January 2023 onwards. Pension in such cases may be immediately restored to pension on wages up to the ceiling of Rs. 5000/- or Rs. 6500/-.

However, before revising any pension entitlement, an advance notice should be issued to the pensioner so that he / she has an opportunity to prove the exercise of option So under Para 11(3) before his retirement prior to 1% September 2014. Further, any recovery “which may arise after such revision should be done in a staggered and persuasive manner. The RPFC-I / officer incharge of the region will be the competent authority to re-determine the pension entitlement and initiate recovery, if any.

ACC Zones and RPFCs of the regions are advised to ensure that pension on wages exceeding wage ceiling of Rs. 5000/- or Rs 6500/- is sanctioned/ continued only in cases which fall within the directions contained in Para 44(ix) read with Para 44 (vi) of Hon’ble Supreme Court judgement dated 04.11.2022. Accordingly, if in any case, pension was revised erroneously, such pension may be immediately stopped and restored to pension on wages up to the ceiling of Rs. 5000/- or Rs 6500/- only, in accordance with directions contained in Para 44 (ix) read with Para 44 (v) of Hon’ble Supreme Court judgement dated 04.11.2022.

Utmost care should be taken to identify such cases where higher pension was granted on account of judgement of any Court. In such cases a favourable order shall be obtained from the concerned Court citing the order of Hon’ble Supreme Court dated 04.11.2022 before going ahead with stopping/ restoration of pension to wages up to ceiling of Rs. 5000 or Rs 6500/-.

[This issues with the approval of CPFC]

Yours faithfully,

(Aprajita Jaggi)

Regional P.F. commissioner-I (Pension)