Fixation of Pension for Pre-2016 Pensioners With Example – 7CPC recommendations

The Commission recommends the following pension formulation for civil employees including CAPF personnel, who have retired before 01.01.2016:

i) All the civilian personnel including CAPF who retired prior to 01.01.2016 (expected date of implementation of the Seventh CPC recommendations) shall first be fixed in the Pay Matrix being recommended by this Commission, on the basis of the Pay Band and Grade Pay at which they retired, at the minimum of the corresponding level in the matrix. This amount shall be raised, to arrive at the notional pay of the retiree, by adding the number of increments he/she had earned in that level while in service, at the rate of three percent. Fifty percent of the total amount so arrived at shall be the revised pension.

ii) The second calculation to be carried out is as follows. The pension, as had been fixed at the time of implementation of the VI CPC recommendations, shall be multiplied by 2.57 to arrive at an alternate value for the revised pension.

iii) Pensioners may be given the option of choosing whichever formulation is beneficial to them.

It is recognised that the fixation of pension as per formulation in (i) above may take a little time since the records of each pensioner will have to be checked to ascertain the number of increments earned in the retiring level. It is therefore recommended that in the first instance the revised pension may be calculated as at (ii) above and the same

may be paid as an interim measure. In the event calculation as per (i) above yields a higher amount the difference may be paid subsequently.

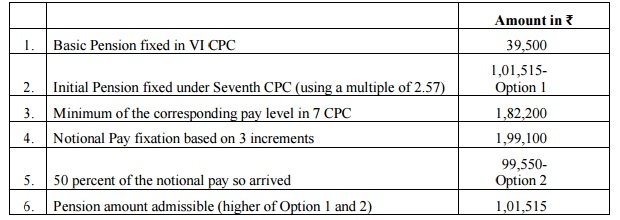

Illustration on fixation of pension based on recommendations of the Seventh CPC

7th Pay Commission Pay Matrix Table (Civilian Employees)

Case I

Pensioner ‘A’ retired at last pay drawn of ₹79,000 on 30 May, 2015 under the VI CPC regime, having drawn three increments in the scale ₹67,000 to 79,000:

Case II

Pensioner ‘B’ retired at last pay drawn of ₹4,000 on 31 January, 1989 under the IV CPC regime, having drawn 9 increments in the pay scale of ₹3000-100-3500-125-4500

Source: 7th Pay Commission Report Download Click here

Continue read: 7th Pay Commission

Continue read: 7th Pay Commission Highlights

Continue read: 7th CPC Pay Calculator as per 7th CPC recommended

JOSEF E A says

Dear Sir/Madam,

My basic pension fixed as 6090/-. I am took VRS on 1/8/2009 (CRPF). Then what is m;y pension in 7th CPC.

T.Ranganatha Rao Rao says

Addnl Pension 0f 20% for coplecting 80 Years. For revised Pension as per 7th Pay commission whether the additional pension of 20% is on Revised Pension .Please clarify.

Mukesh kumar sharma says

Sir may I request to all of u watching 7CPC calculation step and clear my doubt about the calculation method about Option I and Option II. Here very clear to use IV CPC basic and VI CPC basic but why not the basic pay table used for Vth and VI CPC why the table of IV CPC . It is my question because my pension is not fix on the actual pay table of VI CPC and V th CPC. Some thing is wrong about the pay revision table. How to draw a Hav of GpY Q/S 16/03/09 days and pension fix Rs 1687/- during 2004 having elapsed of 12 Yrs only one CPC i.e. VI CPC is declare during the period. Why not shown and granted the pension to retiree pre 2006. Who is benefitted for this. Please see the calculation step of Option II which was shown the IV CPC may be here is used the figure of V CPC may be for calculation of 2.57 is the loop whole for Govt.

D C Joshi says

Sir, I was enrolled in the army on 24.8.1986 and retired on 31.12.2007. Am I applicable to PBOR or not? My basic pay is 7280. what will be the expected pay band?

A.G.Swamy Retired Dy.Commandant says

I A.G.Swamy Retired Dy.Commandant from CRPF am stating that CAPF ie CRPF BSF CISF ITBP ASSAM Riffle SSB etc,are the first line of Force to combate against enemy attack on the border area and terrorist attack in the terrorist area in the state level. And also CAPF is performing the succesfull duty of by-election and general election in India. These above forces are called as Central Para Para Military Force in India like Defence Force under Defence Ministry..What I would like to say that the CPMF also may be considered to pass OROP so that their moral may be boosted up.